Brixton raises cash for Atlin exploration

North of 60 Mining News – January 1, 2019

Last updated 9/25/2020 at 10:32am

Brixton Metals Corp. Dec. 19 announced that it has raised C$2.78 million for further exploration of Atlin Goldfields project in the Golden Triangle region of northwest British Columbia.

The private placement financing involved the issuance of 4.9 million units at C15 cents each, with one unit consisting of a Brixton Metals share and one warrant, and 12 million flow-through shares at C17 each.

Each warrant issue entitles the holder to acquire an additional Brixton share at C$25 for a period of two years.

Under a provision of Canada's Income Tax Act, flow-through financings allow Canadian companies to transfer expenses for exploring for minerals in Canada to individual investors that purchase the flow-through shares. The flow-through investor, in turn, can apply his portion of the exploration expense to reduce or eliminate his tax liability.

Two Brixton insiders bought 106,650 of the flow-through shares offered by the company.

Brixton intends to use the net proceeds from the financing to further explore its Atlin Goldfields project and for general working capital.

Atlin Goldfields

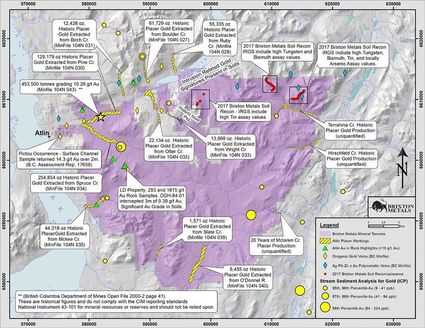

Since 2016, Brixton has accumulated mineral rights covering roughly 1,000 square kilometers (386 square miles) of the historical Atlin Mining District.

This enormous property extending east from the community of Atlin blankets an area that has produced more than 600,000 ounces of placer gold over the past 120 years.

Despite this long and robust placer mining history, only limited hard rock exploration has been conducted for the source of the gold.

The Yellowjacket Mine, located seven kilometers (4.3 miles) east of Atlin, is one example of bedrock hosted gold mineralization identified on the property. Shallow core drilling here in the late 1980s and early 2000s identified high-grade gold mineralization in multiple zones within an 80-meter-wide shear zone.

Highlights from drilling at Yellowjacket in 2003 and 2004 include: 5.6 meters of 513.5 grams per metric ton gold in hole YJ03-01; 0.5 meters of 128.2 g/t gold in YJ04-01; 6.1 meters of 40.1 g/t gold in YJ04-07; and one meter of 142.4 g/t gold in YJ04-20.

The Imperial Mine, another historical lode gold operation roughly 3,000 meters northwest of the Yellowjacket Mine, has a history that dates back to 1899, immediately following the discovery of placer gold in the area.

Historic records indicate that underground mining of a 150-meter-long gold-bearing quartz vein at Imperial produced 268 metric tons of ore averaging 11.5 g/t gold.

Brixton has identified other areas across the Atlin Goldfields property with similar high-grade lode gold potential.

The LD showing, located about 10 kilometers (six miles) southeast of Yellowjacket, is one such example.

Previous exploration at LD has discovered gold mineralization associated with quartz veins hosted within a shear zone. Grab samples collected by Brixton geologists have assayed up to 293 g/t gold. During 2018, the company completed geologic mapping, rock sampling, biogeochemical studies, and soil sampling to define a gold-in-soil anomaly 1,200 meters wide by 2,000 meters in strike length. Brixton said this anomaly is open to expansion.

The Pictou showing, situated about five kilometers southwest of Yellowjacket, is another gold prospect Brixton explored in 2018.

Records going back to 1899 indicate that 29 meters of underground workings discovered gold-bearing quartz veins hosted in altered ultramafic rocks at Pictou. Homestake Minerals conducted exploration there from 1987 to1988 at the historic showing and reported grab samples ranging from 15 to 60 g/t gold. The best channel sample across the showing assayed 14.3 g/t gold over two meters. Chip sampling by Brixton of outcrop in the vicinity of the historical underground working at Pictou returned 11.75 g/t, 4.41 g/t and 4.48 g/t gold.

In 2018, Brixton Metals conducted geological mapping, rock and chip sampling, biogeochemical studies, and collected 2,500 soil samples over select areas at Pictou. This work defined several gold-in-soil anomalies in the area.

Moving forward, Brixton Metals said it will utilize modern geological, geochemical and geophysical exploration techniques in the vicinity of these targets to better understand geologic controls on high-grade gold mineralization and develop a modern exploration model for the Atlin Camp.

The company has commenced re-logging and lithogeochemical – the study of composition, structure and chemical properties of rock and minerals – analysis of core from drilling at Yellowjacket with the goal of creating a new 3D geologic model.

Brixton plans to begin rotary air blast and core drilling at Atlin in early spring. To support this exploration, the company will build a new camp at the Yellowjacket mine site.

–SHANE LASLEY

Reader Comments(0)