Novagold focused on optimizing Donlin

Mining Explorers 2019 – Published Nov. 1, 2019

Last updated 8/14/2020 at 9:24am

Novagold Resources Inc.

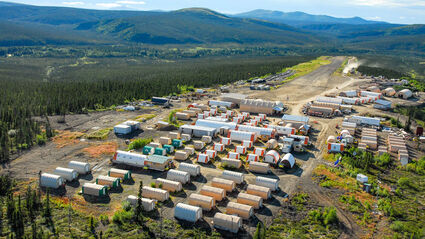

The Donlin Gold camp, which remains fully intact after a 2019 wildfire there, houses crews carrying out fieldwork to support optimization and engineering studies at this 39-million-oz gold project in Southwest Alaska.

With the 2018 sale of its 50 percent interest in the Galore Creek copper-gold project in British Columbia, Novagold Resources Inc. is singularly focused on advancing the Donlin Gold Mine project in Alaska toward production.

In dichotomy, Barrick Gold Corp., Novagold's equal co-owner of Donlin Gold, significantly expanded its gold project portfolio with the finalization of a merger with Randgold Resources Ltd. at the onset of 2019.

The Barrick-Randgold merger have caused Novagold shareholders and others to question whether Donlin Gold fits into the mega-gold-miner's future plans, especially since Barrick intends to sell non-core assets as it restructures the combined portfolio.

Novagold's largest shareholder and chairman, Thomas Kaplan, does not believe Barrick will be willing to sell a North American gold asset as well-endowed as Donlin.

"Is there any reason why Barrick should sell it? From my perspective, 'no'," he said in response to an analyst's question on the topic earlier this year.

Kaplan believes either decision by the new Barrick management team will be good for Novagold.

"Anything that allows us to have a partner, whether it's Barrick or whomever, will be accretive to us, because we have the best story in the space," the Novagold chairman said.

What makes the Donlin story so compelling is 39 million ounces of gold in 541 million metric tons of measured and indicated resources that average 2.24 grams per metric located in the United States.

A 2011 feasibility study for Donlin Gold envisions a 53,500-metric-ton-per-day operation that would produce an average of roughly 1.1 million oz gold annually over a projected 27-year mine-life. This is more yearly gold than all of the rest of the mines in Alaska currently produce, combined.

The price tag to build this mine in a remote part of western Alaska, however, was calculated at nearly US$7 billion, which includes a roughly US$1 billion pipeline to deliver natural gas to the enormous gold project about 300 miles west of Anchorage.

Donlin Gold LLC – a joint venture owned equally by Novagold and Barrick – has secured the federal permits needed to build this mine and is working to secure the last of the requisite state permits by the end of 2019.

As the permitting wraps up, the JV is looking into options that would bring down costs and improve returns.

This optimization work includes a 16-hole drill program in 2017 that provides a better understanding of the mineralization and structures within the targeted zones.

Highlights from this program include: 130.5 meters grading 5.93 g/t gold; 39 meters of 9.34 g/t gold; 43.9 meters of 7.6 g/t gold; 64 meters of 5.09 g/t gold; and 30.4 meters of 10.3 g/t gold.

These long intersections of five to 10 g/t gold demonstrate that more selective mining could deliver higher grades.

Novagold and Barrick have indicated the potential that Donlin Gold will start out as a somewhat smaller mine that focuses on higher-grade portions of the deposit, an operation that could be scaled up in the future.

Such a strategy, coupled with incorporating new technologies and other ideas not considered in the 2011 study, would reduce initial capital outlays and would likely improve project economics.

This year, Novagold and Barrick each contributed US$13 million toward ongoing optimization studies, permitting and community initiatives during 2019.

"With key permitting activities largely complete, our focus is also on integrating scoping-level optimization analyses into a study that should serve as the basis for an updated project development plan," Novagold Resources President and CEO Greg Lang said in July. "In this regard, Novagold is collaborating with Barrick's new management and technical team to advance the project in a financially disciplined manner with a strong focus on furthering our geological understanding, engineering excellence, environmental stewardship and safety."

The results of the optimization work are expected to be detailed in an updated feasibility study to be completed once the new Barrick team settles in and has an opportunity to go over the extensive amount of work that has been carried out at this world-class gold project in Southwest Alaska.

Reader Comments(0)