A pipeline of CORE Alaska gold assets

Mining Explorers 2022 - January 19, 2023

Last updated 1/18/2023 at 11:27am

Crews extend underground development at Contango ORE's high-grade Lucky Shot gold project in Alaska.

As an Alaska-based mineral explorer that is listed on the NYSE American stock exchange and involved with advancing two gold mines toward production, Contango ORE Inc., commonly referred to simply as CORE, is unique in the realm of junior mining companies.

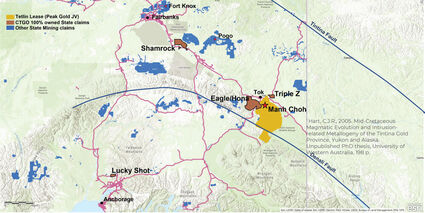

Led by president and CEO Rick Van Nieuwenhuyse, CORE has assembled a pipeline of Alaska gold projects along the highway system in Alaska that span the gamut from discovery to mine development.

"I have spent a good part of my career working on remote projects like Donlin and the Ambler District – after 40 years I figured out that I should stick closer to the roads," Van Nieuwenhuyse said during a Contango ORE presentation at the 2022 Precious Metals Summit in Beaver Creek, Colorado.

CORE's road-accessible portfolio includes the high-grade Manh Choh and Lucky Shot gold mine projects and three earlier staged mineral exploration assets – the Eagle-Hona gold and Triple Z copper-gold projects west and north of Manh Choh, respectively; and the Shamrock gold project in the Richardson Mining District about 70 miles southeast of Fairbanks.

Manh Choh gold in 2024

The most advanced project in CORE's portfolio is Manh Choh, a 1-million-ounce gold mine project being developed under the Peak Gold Joint Venture – a partnership between Kinross Gold Corp. (70%) and CORE (30%).

Upon the July completion of a feasibility study that detailed an economically robust mine at Manh Choh, the Peak Gold JV officially decided to move forward with development of an operation that is expected to produce roughly 1 million gold-equivalent oz, which includes the value of both the gold and silver recovered, annually over an initial 4.5 years.

The study details a plan to truck high-grade ore mined from two pits at Manh Choh roughly 250 miles to Kinross' Fort Knox Mine north of Fairbanks. This ore is to be processed through the existing Kinross Alaska mill and the tailings stored on the Fort Knox property.

With the high-grade feedstock from Manh Choh, which will be roughly 10 times higher than ore currently being processed through the Kinross Alaska mill, the gold production at Fort Knox is expected to jump to 400,000 oz per year.

Leveraging the existing facilities at Fort Knox eliminates the need to permit, finance, and build a mill and tailings facilities at Manh Choh. Essentially a rock quarry type of operation also significantly reduces environmental disturbance and lowers the overall greenhouse gas emissions, compared to developing and operating new processing and tailings storage facilities onsite.

Kinross estimates the average all-in sustaining costs per gold-equivalent oz produced from Manh Choh to be approximately $900, which would result in a margin of over $800/oz at the current price of gold.

Given the positive economics, Kinross made the official decision to move forward with development, and the Peak Gold Joint Venture approved a 2022 budget of $39.6 million to begin the mine development work at Manh Choh.

"We are very excited to achieve this important milestone for the company and its shareholders," said Van Nieuwenhuyse. "Board member, Curt Freeman and Board Chairman, Brad Juneau discovered this orebody nearly ten years ago through hard work and by applying solid exploration principles. They worked closely with the Tetlin tribe to develop a strong working relationship which Kinross continues today."

In addition to mine development, the Peak Gold JV budgeted $3 million for exploration testing targets that could add more high-grade gold to Manh Choh and extend the life of this first Kinross Alaska satellite mine.

High-grade Lucky Shot

As Kinross leads the efforts to put Manh Choh into production by 2024, Contango is advancing the development of a high-grade underground mine at Lucky Shot.

A road-accessible project about 75 miles north of Anchorage, the 8,590-acre Lucky Shot property blankets a large portion of the Willow Creek Mining District, including the pre-World War II Lucky Shot and War Baby mines. It is estimated that from 1918 until being shut down by the federal War Production Board in 1942, these two underground operations produced more than 250,000 oz of gold from 169,000 tons of ore, indicating an average head grade of around 1.5 oz of gold per metric ton.

A 2016 calculation completed for former operators Miranda Gold Corp. and Alaska Gold Torrent Inc. outlined 206,500 metric tons of what is now being treated as historical measured and indicated resources averaging 18.3 grams per metric ton (121,500 oz) gold and 59 thousand metric tons of inferred resource averaging 18.5 g/t (35,150 oz) gold at Lucky Shot.

With its sights set on establishing a large enough resource to support a modern mine at Lucky Shot, CORE has rehabilitated and is expanding the historical Enserch tunnel, which is serving as a platform for underground drilling.

In addition to drilling, CORE is extending the underground workings to intersect the Luck Shot Vein, which will provide bulk sample material, and onward to the Lucky Shot tunnel, which will provide access to the Coleman block that hosts the 2016 resource.

Through this work, the company aims to establish a high-grade resource with at least 500,000 oz of gold.

"I think this is a pretty easy project for us to move forward and be our second mine in operation in Alaska," Van Nieuwenhuyse said during his presentation at the 2022 Precious Metals Summit.

The CORE CEO said shipping the ore to the hungry Kinross Alaska mill or processing the free-milling ore at Lucky Shot are potential options for the high-grade underground gold mine.

Overall, the Lucky Shot vein extends for at least a mile from the Coleman block through the Lucky Shot block, where the Enserch tunnel is located, and onto the War Baby block.

Reader Comments(0)