Newmont makes $17B offer for Newcrest

North of 60 Mining News - February 6, 2023

Last updated 3/2/2023 at 3:16pm

Newcrest Mining Ltd.

Core from drilling at East Ridge, a large resource expansion zone at Newcrest's Red Chris Mine in BC's Golden Triangle.

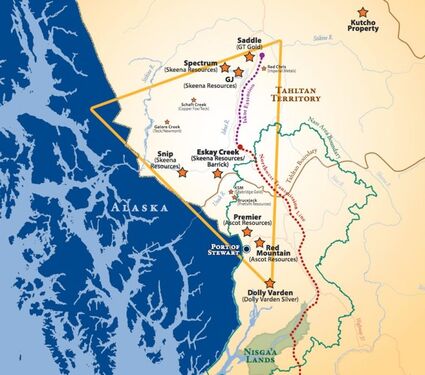

Proposed merger could have major implications for several mining projects in BC's Golden Triangle.

Over the weekend, Newcrest Mining Ltd. and Newmont Corp. confirmed rumors of a proposed merger that has major implications for the future of mining in British Columbia's Golden Triangle.

"We believe a combination of Newmont and Newcrest presents a powerful value proposition to our respective shareholders, workforce and the communities in which we operate," said Newmont President and CEO Tom Palmer.

Australia-based Newcrest operates Red Chris and Brucejack, the only two large-scale mines currently in production in the Golden Triangle region of Northern BC.

Red Chris is a large porphyry gold-copper mining operation that Newcrest bought a 70% interest in 2019 and operates under its joint venture with Imperial Metals Corp. Brucejack is a high-grade underground gold mine that Newcrest bought full ownership of in 2022.

Newmont, on the other hand, bought a 50% joint venture interest in the world-class Galore Creek porphyry copper-gold project in Northern BC in 2018 and gained full ownership of the Tatogga gold-silver-copper project about 20 kilometers (12.5 miles) away from Red Chris through a US$311 million buyout of GT Gold Corp. in 2021.

While both companies have impressive portfolios of mining assets outside of the Golden Triangle, their individual portfolios really merge in this emerging Northern BC jurisdiction.

A $17 billion proposal

Newmont has submitted a proposal to acquire Newcrest through an all shares transaction under which Newcrest shareholders would receive 0.38 Newmont shares for every Newcrest share held. This represents a roughly US$17 billion buyout offer based on Newmont's closing price at the end of trading on Friday, Feb. 3.

If the transaction is finalized as proposed, Newcrest shareholders would own 30% and Newmont shareholders would own 70% of the merged company.

Newmont's nonbinding proposal is subject to certain customary conditions, including due diligence by both parties and a recommendation from both boards of directors to vote in favor of the proposal.

"The proposed transaction would join industry-leading portfolios of assets and projects to create long-term value across the combined global business, and we welcome the consideration of Newcrest's board of directors," said said Newmont President and CEO Tom Palmer.

The Newcrest board of directors rejected a similar proposal previously tendered by Newmont to buy all Newcrest shares at an exchange rate of 0.363 Newmont shares per Newcrest share because it "would not deliver sufficiently compelling value to Newcrest shareholders."

The Newcrest board is considering the new proposal with its financial and legal advisors.

Building synergies

The consolidation of Newmont and Newcrest assets would create major synergies in Northern BC and the Yukon.

Newcrest has already developed synergies between Red Chris and Brucejack that are saving money at both mines.

Combining these assets with Galore Creek, which is near the development stage, and Tatogga, which is at the advanced exploration stage, would create a major district-scale copper and gold-producing hub for Newmont.

While Newcrest has built a relatively strong working relationship with the Tahltan Nation, Newmont's plans for mining at Tatogga have raised some concerns among the members of this First Nation, whose traditional territory covers roughly 70% of the Golden Triangle.

In 2021, the Tahltan Central Government announced it was working with the provincial government to negotiate and reach an agreement to address immediate Tahltan concerns over the pace and scale of mineral development near the Northern BC community of Iskut, as well as areas of cultural importance to the Tahltan.

Red Chris operates about 10 miles (16 kilometers) southeast of Iskut, and Newmont hopes to develop a similar mine at the North Saddle deposit on the Tatogga property, which is only about four miles (six kilometers) southwest of the Tahltan community.

As a means of addressing concerns about mining near Iskut, Newmont acquired five Northern BC properties from Skeena Resources Ltd. in 2021 and turned much of the newly acquired property over to support the land use planning objectives of the Tahltan Nation and the Iskut community.

While the Tahltan Central Government recognizes Newmont's efforts and celebrates the opportunity these steps create, it said at the time that the North Saddle Mine "journey is far from over."

A centralized mill at Red Chris that processes ore from the nearby North Saddle deposit would greatly reduce the environmental footprint at Tatogga. While this idea has not been put forward by either mining company, it may offer a solution that allays some of the Iskut community concerns and allows Newmont to move forward with North Saddle mining.

Additional synergies could be realized with the development of a mine at Galore Creek, a world-class copper-gold project about 120 kilometers (75 miles) southwest of Red Chris, being advanced by a joint venture equally owned by Newmont and Teck Resources Ltd.

Newmont's Coffee gold mine project in the Yukon, which lies 800 kilometers (500 miles) northwest of Red Chris, would likely also enjoy synergies from an expanded Newmont presence in BC's Golden Triangle.

Reader Comments(0)