Yellowknife emerging as EV metals hub

With rare earths and lithium to the east, cobalt to the west, Yellowknife is shaping up as vital northern link in supply chain North of 60 Mining News - April 7, 2023

Last updated 4/10/2023 at 6:23am

Adobe Stock

Home to Canada's only rare earths mine, an emerging district-scale lithium province, and a cobalt-bismuth-copper-gold mine project within a 100-mile radius, Yellowknife is shaping up as a northern link in North America's EV supply chain.

The Northwest Territories capital city of Yellowknife is emerging as a northern link in North America's electric vehicle supply chain. Already home to Canada's only rare earths mine, a 160-kilometers (100 miles) area around this northern mining town happens to be enriched with the lithium and cobalt that is in massive demand for EV batteries, along with numerous other minerals critical to both Canada and the United States.

A roughly 9,600-square-kilometer (3,700 square miles) area that extends 120 kilometers (75 miles) east of Yellowknife to Vital Metal Ltd.'s Nechalacho rare earths mine is riddled with hardrock lithium sources known as pegmatites.

Though this Yellowknife Pegmatite Province was first identified roughly 80 years ago, the market for lithium found in the distinctive white crystalline rock formations that gives this province its middle name was minuscule until the rise of lithium-ion batteries that power cordless electronics and now EVs.

With soaring demand driving the price of lithium to stratospheric levels, a group of battery metals-focused junior mining companies are investing millions of dollars this year to explore the distinctive white pegmatites that can be seen when flying over the Yellowknife Pegmatite Province.

As this historical pegmatite province attracts new interest, Fortune Minerals Ltd. is petitioning the U.S. and Canadian governments for funds to help advance its near development staged Nico bismuth-cobalt-copper-gold mine project about 160 kilometers (100 miles) northwest of NWT capital city to production.

Together, the rare earths, lithium, and cobalt projects surrounding Yellowknife could provide North American manufacturers with an alternative to China for many of the minerals critical to EVs, green energy, high-tech, military hardware, and consumer goods.

"The global demand for these minerals in the years to come will be enormous, and we're highly dependent on China," U.S. Treasury Secretary Janet Yellen said during recent testimony before the House Ways and Means Committee. "One of the goals of the IRA (Inflation Reduction Act) is to broadly strengthen supply chains for these critical minerals and their processing."

With the northern end of North America's rail system extending to the community of Hay River on the south shores of Great Slave Lake, very little infrastructure is needed to connect the critical mineral projects around Yellowknife to North America's supply chains.

Lithium lying in wait

While the expansive Yellowknife Pegmatite Province has been known for eight decades, the interest at that time was in the niobium and tantalum. While it was recognized then that these white crystalline igneous rocks were known to host spodumene, a lithium mineral, there was almost zero use for this lightest of metals at that time.

With the rise in popularity of lithium greases for high-temperature applications after World War II, oil producers revisited the Yellowknife Pegmatite Province in the 1970s and 1980s.

Canadian Superior Exploration Ltd. completed systematic mapping, spodumene crystal counts, trenching, channel sampling, and drilling across this area from 1975 to 1979.

Based on this work, the mineral exploration arm of Superior Oil estimated that the top 500 feet (152 meters) of the province hosted 49 million tons of pegmatite averaging 1.4% lithium oxide.

When Superior Oil was acquired by Mobil in 1984, the claims holding the largest lithium pegmatites were transferred to a private company that optioned them to Equinox Resources Ltd. in 1985.

Given the positive results from metallurgical testing on bulk samples collected in 1987, Equinox recommended a full feasibility study for mining the pegmatites. The exploration company, however, was acquired by Hecla Mining Company before any further work was completed, and the Yellowknife Pegmatite properties reverted to the private company.

Very little exploration work has been carried out on the lithium-rich properties over the ensuing 35 years.

The private company that picked up the properties covering much of what is considered to be one of the largest known hardrock lithium resources in the world has been lying in wait for a time when the world would demand the critical minerals found in the Yellowknife Pegmatite Province.

$35 million Li-FT

With the rise of EVs driving massive demand for lithium, patience has paid off for the private company that has held onto key Yellowknife lithium properties for the better part of four decades.

Under a deal finalized at the end of 2022, the new Li-FT Power Ltd. issued 18 million shares to gain full ownership of the longtime owner of the Yellowknife claims.

"The Yellowknife Lithium Project is a tremendous opportunity to consolidate numerous lithium pegmatites that have the potential to be one of the largest hard rock lithium resources in North America," said Li-FT Power CEO Francis MacDonald. "The project was held privately for 35 years without having any exploration work completed at a time when lithium was not an exciting commodity."

As part of the deal, Li-FT also gained full ownership of the Cali project in western NWT near the Yukon border, along with roughly C$11.7 million in cash and cash equivalents.

With cash it already had in its treasury, the deal provided C$17 million to advance Yellowknife and the other lithium projects in its portfolio.

Li-FT's exploration chest got much richer with the recent closing of a C$35 million (US$25.5 million) financing for exploration of its lithium projects in Canada.

While Li-FT also has lithium properties in Quebec, the newly-formed junior has made it clear that its 141,572-hectare (349,832 acres) Yellowknife lithium project is its flagship.

After optioning two additional properties in the area, Li-FT's Yellowknife Lithium project covers at least 16 known pegmatites on mineral leases that are roughly concentrated into two groups – one road-accessible cluster about 30 kilometers (19 miles) northeast and a second set near the Nechalacho Mine about 60 kilometers (37 miles) east of the NWT capital.

Historical channel sampling of pegmatite outcrops that are clearly visible on satellite images have produced average grades from 1.1 to 1.59% lithium oxide over widths of seven to 40 meters. These lithium-bearing pegmatites can be traced on the surface for 100 to 1,800 meters along strike.

Given the amount of historical work done on the Yellowknife project, Li-FT plans to move right into resource development drilling, with its inaugural program slated to begin later this year. The well-financed junior also plans to carry out scout drilling this year to better understand the size potential at the Cali project near NWT's western border.

In the meantime, the company has launched a 5,000-meter discovery drill program at its Rupert lithium project in Quebec.

North Arrow joins hunt

While Li-FT may be the first and biggest mover in the Yellowknife Pegmatite Province, it is not the only mineral exploration company looking to quickly establish this area as the northern link in the North American lithium battery supply chain.

North Arrow Minerals Inc., best known for its diamond exploration in NWT and Nunavut, earlier this year announced the acquisition of the DeStaffany lithium-tantalum-niobium project on the north shores of Great Slave Lake and about 18 kilometers (11 miles) northeast of the Nechalacho rare earths mine.

Exploration carried out in the 1940s and 1950s identified two known pegmatites enriched with lithium, along with the tantalum and niobium that were the primary target of exploration at the time.

Moose 1, which is exposed on surface for about 370 meters, is roughly five meters wide on average and is up to roughly 11 meters at its maximum exposed thickness. A 7.5-meter channel sample of this spodumene pegmatite averaged 1.5% lithium oxide.

Moose 2, which surfaces for about 450 meters along strike and is up to 30 meters wide, was bulk sampled for tantalum, niobium, and tin in the 1940s and 1950s. This sampling returned up to 2.73% lithium oxide from samples over 250 meters of strike. This pegmatite, however, was never drilled for lithium due to the very few uses of this now-critical battery metal.

A photo of a roughly eight-meter (25 feet) pit wall from historical bulk sample mining shows very large spodumene crystals dominate the lower half of the exposed Moose 2 pegmatite that North Arrow geologists are eager to sample.

"It provides ready access to the richest part of the pegmatite. We will be able to collect some large samples here that will be useful to help us do some mineral characterization and liberations studies of the spodumene-rich portions of the Moose 2 pegmatite," said North Arrow Minerals President and CEO Ken Armstrong.

In preparation for an initial field evaluation of the Moose 1 and Moose 2 pegmatites, North Arrow is reviewing available data related to past work at DeStaffany, including a 1998 litho-geochemical dataset consisting of composite bedrock samples collected throughout the property. The company says this data confirms lithium and cesium alteration halos associated with the Moose pegmatites, and has also been used to identify eight additional anomalies that potentially represent alteration related to undiscovered pegmatites.

Four of the geochemical targets correspond with features of interest identified from recently acquired GeoEye satellite imagery, including one target area where pegmatite was noted in the litho-geochemical survey data.

"Priority targets identified by North Arrow's ongoing review of historic datasets and new satellite imagery will help focus initial prospecting work this summer, with the goal of discovering new spodumene pegmatites within the DeStaffany property," Armstrong said.

Adding to DeStaffany's intrigue, sampling in 1998 and 2001 returned 0.92% and 6.5% nickel at a showing just north of Moose 2.

Armstrong says elevated copper, cobalt, and platinum group metals are associated with the nickel sulfide mineralization at the Moose Nickel showing.

"The nature of this showing is something that is not well understood and it is something we can also take a look at while we are doing our evaluation of the lithium deposits on the property," the North Arrow CEO said during a March 30 presentation on DeStaffany.

North Arrow's primary goal for 2023 exploration at DeStaffany is to determine if a resource can be outlined at Moose 1 and Moose 2 for saleable spodumene concentrates, while exploring the project's wider potential.

In addition to collecting bulk samples of the Moose pegmatites, the company plans to carry out channel sampling ahead of drilling of the two primary targets later in the season.

At the same time, geologists will be evaluating the other lithium and nickel prospects identified across the 1,843-hectare (4,554 acres) property.

In addition to DeStaffany, North Arrow recently optioned the Bathurst Inlet lithium property in Nunavut.

Located about 12 kilometers (7.5 miles) from the port facility servicing Sabina Gold and Silver's Back River gold mine project, Bathurst Inlet covers a series of mapped and interpreted pegmatites.

This earlier-staged Nunavut property, however, is secondary to DeStaffany.

Both properties are being acquired as part of North Arrow's strategic partnership with Panarc Resources Ltd., a privately-held prospect generator associated with Aurora Geosciences Ltd.

More new lithium players

At least two other exploration companies – Gama Explorations Inc. and Patriot Battery Metals Inc. – have joined the resurgence of interest in the Yellowknife Pegmatite Province.

In January, Gama announced that it has optioned Muskox, a roughly 5,000-hectare (12,350 acres) lithium property about 45 kilometers (28 miles) east of Yellowknife, from RGV Lithium Explorations Inc.

Much like the rest of the lithium projects east of Yellowknife, pegmatites were first identified at Muskox eight decades ago, but very little modern lithium exploration has been carried out.

The most prominent of several pegmatite occurrences identified at Muskox is CM-1, a coarse-grained, spodumene-bearing pegmatite that is only 100 meters north of the paved, all-season Highway 4.

This outcropping pegmatite, which measures up to 11 meters wide, has been traced on surface for roughly 730 meters.

Channel sampling completed by RGV last year returned grades as high as 1.34% lithium oxide over five meters and 1.26% lithium oxide over 11 meters.

Most of the Muskox property remains underexplored, and Gama has already identified additional prospective pegmatites from satellite imagery that have no record of historical work, representing exciting targets for the company's initial exploration of this NWT property.

"The Muskox property represents a new pillar for our 2023 exploration program, diversifying and growing our asset base with projects now focused on lithium, nickel and copper," said Gama Explorations CEO Mick Carew. "The Yellowknife Pegmatite Province is a highly prospective and sought after jurisdiction for lithium deposits making the Property a significant addition to our portfolio."

Patriot Battery Metals owns a 40% stake in Hidden Lake, a lithium project that lies on the western border of Muskox.

Foremost Lithium Resource & Technology, which previously owned the other 60% stake in Hidden Lake, recently sold its interest in the project to Youssa PTY Ltd., a private company based in Australia, for C$3.5 million.

Youssa and Patriot's exploration plans for Hidden Lake have yet to be disclosed.

More battery metals at Nico

As the "white gold" rush heats up east of Yellowknife, longtime NWT critical minerals explorer Fortune Minerals is in talks with federal officials in Canada and the U.S. for funding that will push its vertically integrated Nico mine and refinery past the finish line.

Located about 150 road-kilometers (95 miles) north of the Canadian rail system at Hay River, Nico is a near-development stage project that includes an intriguing mix of critical and precious metals.

According to a 2020 development plan based on optimizations of a 2014 feasibility study, a mine at Nico and an associated refinery planned for development in Alberta would produce an average of 1,800 metric tons of battery-grade cobalt sulfate, 1,700 metric tons of bismuth, 300 metric tons of copper, and 47,000 oz of gold annually over the first 14 years of mining.

The cobalt would provide North American manufacturers an alternative to the Democratic Republic of Congo and China for this metal going into lithium-ion batteries used in EVs, renewable energy, and an ever-growing array of electronic and household devices.

Nico also happens to be a globally significant deposit of bismuth, a metal with unique physical and chemical properties critical to a wide range of high-tech and industrial applications.

Recent U.S. Department of Energy national lab breakthroughs on powerful manganese-bismuth permanent magnets with the potential to serve as an alternative to rare earth magnets in EV motors, wind turbines, military hardware, and other applications add additional market upside to this rare metal.

More than 10% of the world's bismuth reserves – deposits where it has been shown economic feasibility for recovering the metal – are found at Nico.

Fortune currently has a grant application with Natural Resources Canada for pilot tests to support detailed engineering for its vertically integrated Nico project. Alberta Innovates has also indicated that it could support the bismuth component of this work.

Fortune has also applied to the U.S. Department of Defense for matching grants of up to US$25 million (C$34.5 million), primarily for detailed engineering, under the Defense Production Act Title III presidential directive in support of the North American battery materials production.

In addition to cobalt and bismuth, the Nico project would produce copper, a metal that is in high demand due to its increased use in EVs and renewable energy infrastructure, and gold, a precious metal that offers a built-in hedge against inflation.

Hub of the North railhead

While Canada's North of 60 territories are not known for the infrastructure required to readily and economically deliver bulk minerals and metals to market, the 160-kilometer (100 miles) radius around Yellowknife is the exception.

First off, you can drive to Yellowknife, and Highway 4 extends roughly 50 kilometers (30 miles) east of the NWT capital. This means that the emerging group of Yellowknife Pegmatite Province explorers can drive within a few kilometers of their projects. In fact, some could be standing on one of their lithium exploration targets within 10 minutes of grabbing a rock hammer out of the back of their vehicle.

For Nico, which lies on the opposite side of Yellowknife, the recently completed Tlicho Road puts this multi-metal mine project within 50 kilometers (30 miles) of all-year highway access.

While being this close to North America's contiguous highway network is considered a major benefit for any mining project in Canada's North, the real unprecedented infrastructure advantage for the critical minerals project around Yellowknife is the proximity to the northmost extent of Canada's railway at Hay River.

Natural Resources Canada

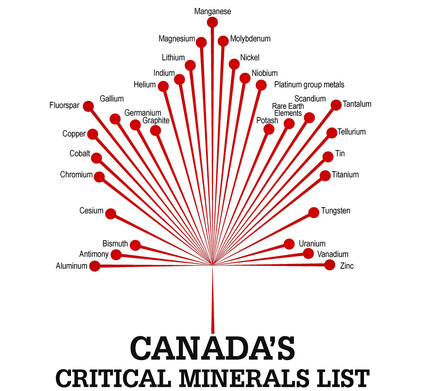

At least 11 of the 31 minerals deemed critical to Canada are found on active exploration, development, and mining projects within 100 miles of Yellowknife.

While it takes about 5.5 hours to drive the 480 kilometers (300 miles) from Yellowknife to Hay River, it is likely that any lithium mines developed in the province east of the NWT capital would go for a more direct route – across Great Slave Lake.

"Barge service could give us access to Hay River and the railhead that is there," Armstrong said of the company's DeStaffany project.

From DeStaffany, it is about 240 kilometers (150 miles) by barge to Hay River.

Vital Metals has already shown the viability of this means of getting critical minerals to market with the shipping of rare earth concentrates to its processing facility in Saskatchewan via barge and rail.

Fortune also plans to load its concentrates on rail cars at Hay River en route to the refinery it will operate in Alberta.

With concentrates rich in rare earths, lithium, cobalt, and bismuth being loaded on railcars at Hay River, "the hub of the North" may emerge as a major northern link in North America's critical minerals supply chain.

Reader Comments(0)