A northern solution to copper shortage

Northern BC, Yukon, and Alaska host vast stores of copper; will they be developed in time to fill the looming copper shortage? North of 60 Mining News - May 5, 2023

Last updated 5/11/2023 at 2:39pm

Adobe Stock

The transition away from fossil fuels means that much more of the global energy will be delivered by copper cables.

The North of 60 Mining area hosts billions of pounds of copper ready to be delivered to a world craving this metal in sky-high demand for wiring the electric vehicles and renewable energy infrastructure that would enable the envisioned low-carbon future. Whether enough of these copper-rich projects are developed in time to circumvent a short circuit of the clean energy transition remains to be seen.

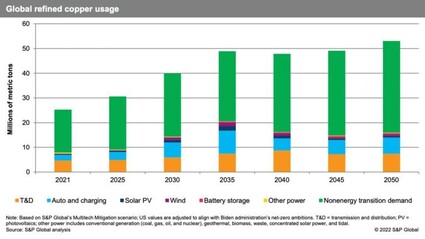

Global Market analysts such as S&P Global have predicted that copper production will need to double by 2035 to meet demands driven by global net-zero emission goals. This means that even if every current copper mine was still producing at today's capacity in 12 years, enough new mines would need to come online to match that production – both highly unlikely scenarios.

In its best-case scenario, S&P Global estimates that annual production from global mines will be 1.6 million metric tons (3.5 billion pounds) short of meeting copper demands in 2035. In its most pessimistic view, this copper shortage is a staggering 9.9 million metric tons (21.8 billion lb).

"The challenge is that if current trends continue ... there's a huge gap," S&P Global Vice Chair Daniel Yergin said upon the release of the copper analysis. "And even if you put on your roller skates and your jet burner [to realize optimistic supply growth], and everything goes right, there's still a gap, because it's enormous. And it's important to recognize that now, not in 2035."

The need to ramp up copper production at a scale that matches the demand of a global economy that favors low-carbon electricity transmitted over powerlines over fossil fuel delivered by pipelines was the primary topic of discussion at the CRU World Copper Conference held in Santiago, Chile.

"If we don't have enough copper, it could seriously short circuit the energy transition," Jeremy Weir, CEO of Trafigura, a French multinational commodity trading company, said during the April conference.

A group of advance-staged exploration projects in Northern British Columbia, Yukon, and Alaska hosts a total of at least 171 billion lb of copper in various resource categories. Not all these resources will be feasible to mine, and the reserves that are mined would feed copper to global markets over operational lives that are measured in decades.

Even so, any of these projects would offer a significant supply of copper and would go a long way toward preventing the clean energy future from short-circuiting.

The question is: Will any of these world-class projects in Northern BC, Yukon, and Alaska come online in time to help fill the looming copper shortage?

Given the timeline for permitting, financing, and building a mine of the scale needed, the launch window is small – even with roller skates and jet burners strapped on.

55 billion lb of KSM copper

Home to four advance-staged copper exploration projects that host roughly 80 billion lb of combined copper in the inferred and indicated resource categories, the Golden Triangle region of Northern BC is in a good position to provide a globally significant amount of copper in the coming years.

The largest single source of copper in BC's Golden Triangle is found at Seabridge Gold Inc.'s KSM project.

According to an early 2022 calculation, five deposits at KSM host 5.4 billion metric tons of measured and indicated resources averaging 0.16% (19.4 billion lb) copper, 0.51 grams per metric ton (88.3 million ounces) gold, 2.4 g/t (414 million oz) silver, and 63 parts per million (742 million lb) molybdenum; plus 5.7 billion metric tons of inferred resource averaging 0.28% (35.1 billion lb) copper, 0.36 g/t (65.6 million oz) gold, 2.2 g/t (406 million oz) silver, and 33 ppm (415 million lb) molybdenum.

Last year, Seabridge completed a prefeasibility study for a financially robust open-pit mine capable of averaging more than 178 million lb of copper, 1 million oz of gold, 3 million oz of silver, and 4.2 million lb of molybdenum annually for 33 years.

A supplemental preliminary economic assessment outlines plans for underground block-cave mining that would extend the life of the KSM for 39 years beyond the operation outlined in the prefeasibility study (PFS).

This second underground phase contemplated in the preliminary economic assessment (PEA) would average 366 million lb of copper, 368,000 oz of gold, 1.8 million oz of silver, and 400,000 lb of molybdenum annually.

"In our updated PFS we focused on the gold-rich deposits because of their faster payback and the relative simplicity of an open-pit only operation. However, we are very mindful that a deep deficit in mined copper is projected to be on the horizon as the world electrifies and moves towards a net-zero carbon future," said Seabridge Gold Chairman and CEO Rudi Fronk.

The more copper-dominant underground phase of mining could be developed alongside the easier open-pit operation outlined in the PFS.

Teck behind two BC copper giants

Teck Resources Ltd. is involved with two world-class Golden Triangle projects – Galore Creek and Schaft Creek – with substantial stores of copper.

Galore Creek, which is being advanced under a joint venture equally owned by Teck and Newmont Corp., is a large source of copper that has been lying in wait for roughly two decades.

A feasibility study was completed for the project in 2005, and road construction began in 2007, but the mine development project was put on care and maintenance later that year.

A prefeasibility study completed in 2011 envisioned a mine at Galore Creek producing 6.2 lb of copper over an 18-year span, which would rank as the largest copper operation in Canada.

Crediting the value of the 4 million oz of gold and 65.8 million oz of silver forecast to be recovered over that mine life, Galore Creek also would be the lowest-cost copper producer in the country.

Galore Creek Mining Corp. is currently working on an updated prefeasibility study that is expected to be finalized around midyear.

As it prepares the copper project for permitting and development, the JV is collaborating with the Tahltan First Nation and local communities.

"Our engagement with Tahltan and communities will continue through 2023 and inform project design and development activities," Galore Creek inked on its website.

The JV is also preparing for 25,000 meters of geotechnical, metallurgical, and resource development drilling slated for this year.

Schaft Creek is a slightly early-staged copper-gold project that lies about 40 kilometers (25 miles) northeast of Galore Creek.

Being advanced under a joint venture between Teck (75%) and Copper Fox Metals Inc. (25%), Schaft Creek hosts 1.35 billion metric tons of measured and indicated resources averaging 0.26% (7.76 billion lb) copper, 0.17 g/t (7 million oz) gold, 1.25 g/t (54.3 million oz) silver, and 0.017% (510.6 million lb) molybdenum.

A preliminary economic assessment prepared for Copper Fox in 2021 outlined plans for a 133,000-metric-ton-per-day mill and open pit mine at Schaft Creek that is forecast to produce roughly 5 billion lb of copper, 3.7 million oz of gold, 226 lb of molybdenum, and 16.4 million oz of silver over 21 years of mining.

This year, the Schaft Creek Joint Venture has budgeted C$17.2 million (US$12.5 million) for a field program that will include 9,000 meters of geotechnical and metallurgical drilling, along with environmental baseline studies and engagement with the Tahltan First Nation.

"These activities are focused on continuing the investigations and confirmations of value-add opportunities to allow potential initiation of a future prefeasibility study," said Copper Fox Metals CEO Elmer Stewart.

Looking ahead to larger field programs moving forward, the 2023 work at Schaft Creek will also include upgrades to the camp that include improvements to the kitchen facility, bunkhouses, existing aircraft runway, and other site infrastructure.

Newmont's BC copper foothold

In addition to its 50% stake in Galore Creek, Newmont is working to advance an earlier-staged copper project in the Golden Triangle and is in the midst of a merger that would give it 70% ownership of Red Chris, the only copper-producing mine currently in the region.

In 2021, Newmont paid US$311 million (C$393 million) in cash to acquire GT Gold Corp., an exploration company that discovered and outlined the large Saddle North copper-gold deposit on its Tatogga property about 120 kilometers (75 miles) northeast of Galore Creek.

According to a calculation completed prior to Newmont's acquisition, Saddle North hosts 298 million metric tons of indicated resource averaging 0.28% (1.8 billion lb) copper, 0.36 g/t (3.47 million oz) gold, and 0.8 g/t (7.58 million oz) silver.

This deposit contains another 2.98 billion lb of copper, 5.46 million oz of gold, and 11.6 million oz of silver in the lower confidence inferred resource category.

Newmont says this deposit "has the potential to contribute future significant gold and copper annual production."

The global mining company is also working on a roughly US$20 billion (C$27 billion) merger with Newcrest Mining Ltd. that would expand its copper and gold production in the Golden Triangle.

Earlier this year, Newmont President and CEO Tom Palmer said the acquisition of Newcrest "would build upon the district potential in British Columbia's highly prospective Golden Triangle through a combination of operating mines and development projects that would deliver value through shared technology, local capabilities, and orebody experience."

Newcrest operates Red Chris and Brucejack, the only large-scale mines currently operating in Northern BC.

Red Chris is a large porphyry gold-copper mining operation that Newcrest bought a 70% interest in 2019 and now operates under its joint venture with Imperial Metals Corp.

The current open pit mine at Red Chris produced more than 65 million lb of copper and 60,000 oz of gold per year.

Newcrest, however, has been developing an underground block cave mining operation that would significantly increase the annual metals output.

A 2021 prefeasibility study details an underground block cave mine at Red Chris that is expected to average roughly 107 million lb of copper and 158,000 oz of gold annually over 31 years of mining.

In preparation for this bulk tonnage underground mine, Newcrest is advancing an exploration decline that will provide a platform for underground drilling, as well as to potentially mine higher grade pods ahead of full-scale block caving.

A Red Chris block cave feasibility study, which includes the option for an electrified mine, remains on track for completion in the first half of 2023.

Negotiations are currently underway for a merger under which Newcrest and its assets would be absorbed by Newmont. The latest publicly disclosed offer involves Newcrest shareholders receiving 0.4 Newmont shares per Newcrest share held.

Based on mid-April share prices of the companies, this offer is valued at US$19.6 billion (C$26.7 billion).

Along with its 50% JV stake in Galore Creek and full ownership of the North Saddle deposit at Tatogga, this pending merger positions Newmont to be a major player in the Golden Triangle and a significant supplier of copper from its Northern BC assets.

Copper prize in the Yukon

The same belt of rock that hosts the copper-rich deposits in Northern BC extends into an area of the Yukon that is also drawing interest from global mining companies looking for sources of the copper needed to wire the clean energy transition.

The biggest copper prize in southern Yukon is Casino, a world-class copper project that has attracted Rio Tinto and Mitsubishi Materials Corp.

Being advanced by Western Copper and Gold Corp., Casino hosts 2.49 billion metric tons of measured and indicated resource averaging 0.14% (7.64 billion lb) copper, 0.18 g/t (14.8 million oz) gold, and 1.5 g/t (117.2 million oz) silver.

A 2022 feasibility study details an economically robust mine that would produce an average of 163 million lb of copper, 211,000 oz of gold, 1.3 million oz of silver, and 15.1 million lb of molybdenum annually over an initial 27-year mine life.

This engineering and economic study for Casino was produced with technical and financial assistance from Rio Tinto, which invested C$25.6 million (US$21.2 million) in 2021 to acquire a nearly 8% stake in Western Copper and a foothold in Casino.

And Rio Tinto is not the only global player interested in Casino.

Earlier this year, Mitsubishi Materials Corp. invested C$21.3 million (US$15.6 million) to gain a roughly 5% foothold in Western Copper.

"The investment by Mitsubishi Materials is a strong endorsement of the Casino project," said Western Copper and Gold President and CEO Paul West-Sells.

To maintain its 7.8% stake, Rio Tinto bought another C$2.3 million (US$1.7 million) of Western Copper shares at the time of the Mitsubishi Materials investment.

With support from Rio Tinto and Mitsubishi Mining, Western Copper is working toward gaining the permits needed for a mine at Casino that can help supply copper to build the clean energy future.

Much like its neighbor to the south, Yukon is already a source of copper that is in increasingly high demand. This copper comes from Minto Metals Corp. namesake mine in the territory.

While not as large as Casino, the Minto Mine has offered a steady supply of copper since 2007. This includes 28.9 million lb produced last year.

Minto Metals plans to boost its copper production above 31 million lb this year and is working on enhancements that will further bolster annual copper output to 40 million lb per year.

A Pebble in copper demand

Despite being an extremely copper-rich state, Alaska does not currently produce any of this metal critical to the low-carbon future.

The largest deposit of copper in Alaska, and among the biggest in the world, is locked up in a long and drawn-out battle for regulatory approvals.

This world-class project is Pebble, which hosts 6.5 billion metric tons of measured and indicated resources averaging 0.4% (57 billion lb) copper, 0.34 g/t (71 million oz) gold, 240 ppm (3.4 billion lb) molybdenum, 1.7 g/t (345 million oz) silver, and 0.41 ppm (2.6 million kg) rhenium.

The Southwest Alaska deposit hosts another 25 billion lb of copper in the inferred resource category.

A preliminary economic assessment published by Northern Dynasty Minerals Ltd. in 2021 outlines plans for a mine at Pebble that would produce an average of 320 million lb of copper; 363,000 oz of gold; 15 million lb of molybdenum; 1.8 million oz of silver; and 12,000 kilograms of rhenium annually over an initial 20 years of mining.

"The significant metal production forecasts and robust financial estimates ... clearly suggest that Pebble is potentially more than just one of the greatest accumulations of copper and other strategic metals ever discovered on American soil," said Northern Dynasty Minerals President and CEO Ron Thiessen.

Even so, it would take more than 170 of these Pebbles to supply the amount of copper that S&P Global estimates to be needed to meet the demands of a world transitioning to clean energy.

As much as the world needs the copper Pebble could provide, its proximity to the Bristol Bay watershed has created a controversy that has prevented its development.

Proponents argue that a modern mine at Pebble could coexist with the fishery and deliver the copper and other metals the world needs. The opposition, however, says the Bristol Bay region is too unique to take a chance.

Toward the end of 2020, the U.S. Army Corps of Engineers denied the federal permits needed to move ahead with the development of a mine at Pebble.

Arguing that this decision is contrary to the law and the Army Corps' own findings, Pebble Limited Partnership, the Alaska-based Northern Dynasty subsidiary advancing this world-class deposit, has appealed the federal agency's record of decision.

In April, the Army Corps agreed that some of the concerns brought up in the Pebble appeal had merit and is now taking a second look at its decision.

"The USACE has recognized that the final decision process for Pebble was not properly undertaken and sent its decision document back to the Alaska District following our appeal over two years ago," said Pebble Limited Partnership CEO John Shively. "I am encouraged that some in the federal government recognize the importance of following a fair and established process for reviewing resource projects in Alaska."

Others in the federal government, however, are working to put restrictions in place that would ensure Pebble's copper remains in the ground.

Earlier this year, the U.S. Environmental Protection Agency decided to exercise its authority under Clean Water Act Section 404(c) to restrict the discharge of dredged or fill material for the construction and operation of a mine at Pebble.

Alarmed by the precedent that would be set by EPA's actions, Alaska Gov. Mike Dunleavy says his administration is prepared to defend Alaska's right and obligation to develop resources on state lands.

"The State of Alaska has the duty, under our constitution, to develop its resources to the maximum in order to provide for itself and its people, so it's important that any and all opportunities be explored in furtherance of this idea," said Dunleavy. "Our opportunities to show the world a better way to develop our resources should not be unfairly pre-empted by the Biden administration under a solely political act."

The EPA's proposed preemptive decision is also counter to the Biden administration's push to lower America's carbon dioxide emissions with an aggressive push toward electric vehicles charged with low-carbon energy.

"The EPA is choosing to sterilize the world's largest undeveloped deposit of much needed copper, gold, silver, molybdenum and rhenium, and this decision cannot stand, because the future of Alaska and the Green Energy Transition is being threatened," said Thiessen.

Road to NW Alaska copper

Pebble is not the only advanced copper exploration project in Alaska that has healthy quantities of critical byproduct metals.

Not quite as large as Pebble but less controversial and much higher grade, the Arctic and Bornite deposits in the Ambler Mining District of Northwest Alaska host roughly 9 billion lb of copper, along with other base, precious, and critical minerals.

Ambler Metals LLC, a joint venture operating company equally owned by Trilogy Metals Inc. and South32 Ltd., is advancing the exploration, permitting, and future development of these and more than a dozen other copper-enriched projects across their Upper Kobuk Mineral Projects (UKMP).

Arctic, which is in the early stages of permitting, hosts roughly 2.5 billion lb of this copper.

A 2020 feasibility study for Arctic detailed plans for a mine that is slated to produce an average of more than 155 million lb of copper, 192 million lb of zinc, 32 million lb of lead, 32,165 oz of gold, and 3.4 million oz of silver annually over a 12-year mine life.

When it comes to copper, the Bornite project, about 16 miles southwest of Arctic, hosts the largest deposit discovered so far at UKMP.

According to the most recent resource calculation, Bornite hosts roughly 6.4 billion lb of copper and 77 million lb of cobalt, a metal critical to the lithium-ion batteries powering EVs and storing intermittent wind and solar electricity.

Bornite also carries at least two other critical minerals – germanium and gallium – though the concentrations and recoverability of these technology metals have yet to be determined.

Ambler Metals currently envisions Bornite as the second mine to be developed at UKMP.

Arctic, Bornite, and several other potential mines in the larger Ambler District will require road access to be economically viable. Such a road to be built by the Alaska Industrial Development and Export Authority (AIDEA) and paid for by tolls collected from the transport of concentrates over the private industrial access received major federal permit approvals in 2020.

In addition to being a major milestone for UKMP, the road approvals bolster other projects along the route, including Valhalla Metal Inc.'s Sun copper-zinc-silver-gold project.

Roughly a year ago, however, the U.S. Bureau of Land Management notified AIDEA that it had suspended its Ambler Road authorizations for further review.

Alaska's entire Washington delegation, along with a large group of Alaska Native leaders from the surrounding region, have called on BLM to promptly complete its review so that the road to this copper-rich district can be built.

"The Ambler Access Project and the development of the Ambler Mining District has the potential to provide not only jobs, but also the critical minerals necessary for our national security," said Carl Burgett, chief of then tribal council for Huslia, an Alaska Native village south of the proposed road. "We should not depend on foreign sources of these minerals when they can be developed more responsibly on our lands, to the benefit of our people and the entire nation."

Which echoes the question: "Will any of these world-class projects in Northern BC, Yukon, and Alaska come online in time to help fill the looming copper shortage?"

Reader Comments(1)

Eidolon writes:

The right answer to this question is all of the above, however, given the thoroughly rotten nature of western political classes and the rampant Unicornism running through them, I have little hope that what needs to happen will happen.

05/05/2023, 8:29 am