AIDEA for Alaska critical mineral funding

North of 60 Mining News - April 5, 2024

Last updated 4/26/2024 at 11:43am

HB122 would authorize AIDEA to issue up to $300 million in bonds and leverage federal funding for critical mineral infrastructure projects in Alaska.

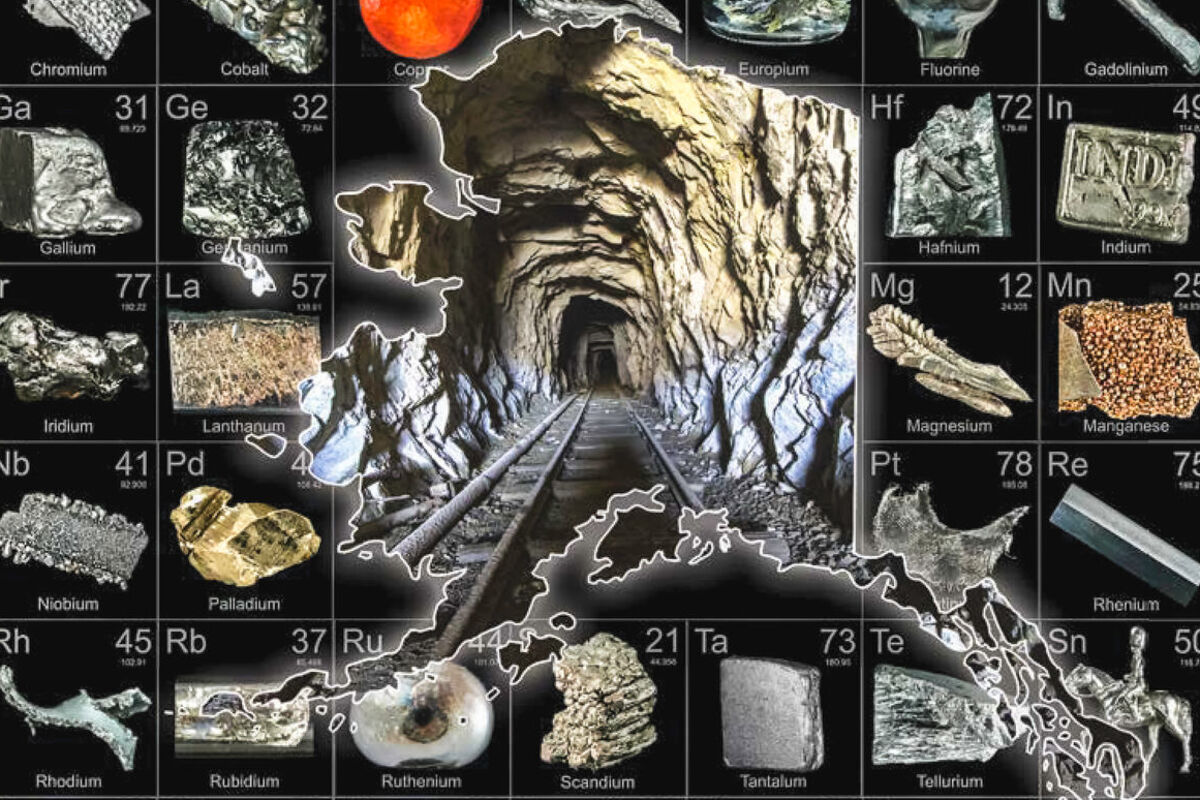

Home to 49 out of the 50 minerals deemed critical to the United States, Alaska has the potential to be a reliable domestic source of the mined materials vital to high-tech, clean energy, and national defense. America's Last Frontier, however, is often lacking when it comes to the infrastructure needed to fully unlock the state's critical minerals potential.

A recent amendment to Alaska House Bill 122 would provide the state with a mechanism for leveraging billions of dollars available through the Bipartisan Infrastructure Law, Inflation Reduction Act, and other federal programs to develop the infrastructure needed to establish the 49th State as a reliable and responsible domestic supplier of the minerals critical to the economy and security of the U.S.

Spearheaded by Representative Tom McKay, the amendment to HB122 would authorize the Alaska Industrial Development and Export Authority (AIDEA) to issue up to $300 million in bonds for critical mineral and rare earth element infrastructure projects such as roads, processing plants, and power generation and transmission.

The issuance of such bonds would allow AIDEA to leverage billions of dollars in matching funds from federal programs aimed at onshoring critical minerals supply chains in the U.S.

The window for leveraging federal grants and loan guarantees, however, is closing.

"The amended HB 122 addresses a time-sensitive need in Alaska's infrastructure financing," said AIDEA Executive Director Randy Ruaro. "As federal programs for energy and critical minerals are approaching their sunset in the next few years, Alaska must be ready to leverage funding for federal match requirements."

Domestic critical minerals needed

The transition to low-carbon energy sources is powering enormous new demand for battery materials, copper, rare earths, and other critical minerals needed for electric vehicles, wind turbines, solar panels, hydrogen fuel cells, and a wide array of other clean energy technologies.

The International Energy Agency has forecast that the market for more commonly used metals such as nickel will double over the course of two decades, and the demand for lesser-used mined commodities like graphite and lithium could rocket as much as 40 times between 2020 and 2040.

This massive demand growth is spurring an every-nation-for-itself competition to secure minerals and metals essential to the low-carbon energy future.

The U.S., however, currently depends on imports for 100% of its supply of 12 of the 50 minerals deemed critical to the nation's economy and security, according to the U.S. Geological Survey's 2024 report on mineral commodities.

The minerals for which the U.S. is completely reliant on other countries for its supply include arsenic and gallium for computer chips, graphite and manganese for lithium-ion batteries, and indium and tantalum for electronic devices.

As you work your way down the 2023 U.S. import reliance list, you find that America depends on other nations for:

• 95% of rare earths – a group of 14 elements used to manufacture a wide array of civilian and military technologies.

• 95% of titanium – a light yet strong metal used in aerospace alloys and now the Apple iPhone 15 Pro.

• 83% of platinum – a precious metal used as a catalyst to scrub pollutants from industrial and automotive emissions.

• 82% of antimony – a metalloid with a wide variety of civilian and defense applications and a top concern of the U.S. Department of Defense.

• 74% of tin – a metal that the tech sector heavily depends on due to its use in solders for the circuitry of virtually all electronics.

• 58% of vanadium – a metal used in high-strength steel alloys and grid-scale renewable energy storage systems.

• 57% of nickel – a metal traditionally used in stainless steel and other alloys but is seeing a massive surge in demand for electric vehicle batteries.

This heavy dependence on countries like China, which was the leading supplier of 24 of the minerals for which the U.S. is net-import-reliant, and Russia, which is a significant global producer of others, has DOE and the Pentagon investing heavily in establishing domestic supplies.

The billions of dollars being invested into onshoring critical mineral supply chains provide Alaska with a once-in-a-century opportunity to establish itself as a major hub for the minerals critical to the 21st century.

Graphite One's world-class Graphite Creek project in western Alaska, Alaska Energy Metals' Nikolai nickel-cobalt project in the state's Interior region, Ucore Rare Metals' Bokan Mountain rare earths deposit on the Southeast Alaska Panhandle, and antimony associated with gold projects being explored by Felix Gold and Nova Minerals are a few of the critical mineral projects currently being advanced in Alaska.

"Alaska should be looked at as a source for these minerals," Ruaro said during a March 28 interview with Mining News.

Well-positioned for critical minerals

While Alaska is rich in the critical minerals being sought by the Energy and Defense departments, it is a large frontier state that lacks much of the infrastructure needed to deliver these elements of innovation into American supply chains. Supporting the development of infrastructure needed to produce and export Alaska's natural resources is one of AIDEA's primary missions.

Among AIDEA's most successful projects is the Delong Mountain Transportation System (DMTS), which delivers zinc and other metals from Red Dog, the largest critical minerals mine in the U.S.

Over the nearly four decades since the DMTS road and port was built, AIDEA has recouped the $180.2 million initial investment from fees for using the Northwest Alaska mine support infrastructure while also advancing the development authority's primary mission to promote, develop, and advance economic growth in Alaska.

"Since mining began, the Red Dog Mine has provided more than 3,000 jobs and over $1.3 billion in payments to the State of Alaska and to the Northwest Arctic Borough," Alaska Gov. Mike Dunleavy penned in AIDEA's 2023 annual report.

With the success of Red Dog and its other investments across Alaska, which includes never having a bond issued going into default, AIDEA has a strong bond rating and is ideally situated to support critical mineral infrastructure projects in the state.

"We are well-positioned in terms of our balance sheet, we have no bonds outstanding right now and we have income coming in," AIDEA Deputy Director Brandon Brefczynski told Mining News.

When it comes to leveraging the billions of federal dollars appropriated for domestic critical mineral projects, AIDEA also has the advantage of being one of the first institutions in the nation to be named as a State Energy Financing Institution (SEFI), a designation that comes with preferential advantages.

"There was some legislation passed that gave the federal Department of Energy roughly $280 billion in loan guarantee authority under what they call a Title 17 program, and that same legislation gave even better terms on borrowing those funds if the entity is a state energy financing institution," Ruaro explained.

"Because we are a SEFI, our leverage is greater than the private sector," he added.

This leverage means that projects bonded by AIDEA could attract $10 in federal matching funds for every $1 dollar bonded. So, for example, a company that wanted to develop a $550 million critical minerals project in Alaska would have the opportunity to receive a $50 million AIDEA bond and a $500 million loan guarantee from DOE, provided the project met the vetting requirements of both agencies.

HB122 offers a critical tool

To help AIDEA lever potentially billions of dollars of federal investment into Alaska, the House Transportation Committee added the critical minerals bonding amendment sponsored by Rep. McKay to HB122, a bill originally introduced to authorize the Alaska Railroad Corporation to issue bonds for replacing its passenger dock terminal in Seward.

AIDEA says the $300 million in bonding authority that would be authorized by the amended HB122 would provide it with the nimbleness to issue bonds for any economically viable critical minerals project that arises and leverage federal matching funds while they are still available.

"This is a good tool for the state to have in its quiver," said Brefczynski. "If there are eligible projects out there, we could fund these projects and it would not be using state general funds."

In addition to the federal funds, any critical mineral infrastructure projects bonded by AIDEA would also attract investments from private sector companies developing or utilizing the infrastructure.

As a result, AIDEA believes that the HB122 critical minerals bonding amendment would further the mission it was given when the development and export authority was created by Alaska legislators in 1967.

"Our mission is economic development and jobs, so anytime there is a financial tool or financial opportunity for us to partner with federal agencies, or use our own authority to advance a project, we are looking out for that," said Ruaro.

At the same time, bonds issued under the amended HB122 would support projects that would provide the U.S. with a more reliable and sustainable alternative to China for the minerals and metals critical to the U.S.

HB122 passed out of the House Transportation Committee on March 18 and has been sent to the House Finance Committee for consideration.

Reader Comments(0)