Concerning mineral exploration trend 2019

Minimal mining profits earmarked for exploration, dearth of grassroots exploration is thinning pipeline of mineral projects North of 60 Mining News – April 1, 2019

Last updated 9/25/2020 at 2:27pm

Kinross Gold Corp.

Roughly 65 percent of the global exploration spending during 2018 went into mine-site and late-stage projects.

As is usually the case this time of year, the mining industry is awash in backward-looking statements designed to allow for more accurate forward-looking statements. Prime among them is one of my favorites, S&P Global's annual "World Exploration Trends 2019", a summary of what happened industry-wide in 2018 and what it may portend for the mining industry in 2019.

The study predicts that global exploration budgets will increase again in 2019, although by a smaller amount, with the focus being on late-stage exploration targets as the industry remains risk averse.

My current back-of-the-sample-bag numbers for 2019 exploration in Alaska are already at $127 million, so S&P's prediction looks spot-on at this point in time.

The study also indicated that the industry remains short of critical new discoveries, with some metals, such as copper, facing widening supply shortfalls exploration unless discovery rates increase significantly.

During 2018, early-stage "grassroots" exploration continued to be a hard sell, with percentages spent on such exploration coming in at 35 percent of total spending compared to late-stage (39 percent) and mine-site (26 percent), which gathered a combined 65 percent of total exploration spending.

Major mining companies were the biggest exploration spenders, contributing 51 percent of the total exploration dollars, while junior explorers were only 32 percent of total spending.

The fact that major mining companies spent only 1.6 percent of their total revenue on exploration in 2018 was also alarming. This figure is near historical lows and the outlook for 2019 looks similar.

Most-favored region status was earned by Latin America, with 30 percent of the global exploration dollars spent there, followed by Asia-Europe with 17 percent and Canada with 15 percent of total exploration spending.

Most-favored metals were gold, with just over half of all exploration spent looking for that metal while copper was the base metal of interest for 22 percent of exploration expenditures.

As was the case in 2017, the battery metals were the darling metals d'jour for 2018, including lithium, up 58 percent to $247.1 million while cobalt exploration spending tripled to $110.8 million.

And finally, mimicking what we saw in Alaska in 2018, the number of drill holes and the number of active projects world-wide increased by 14 percent and 11 percent, respectively.

S&P's forward-looking take on all this is not surprising: "not only must the industry continue to invest in exploration, but the concerning trends that persist, such as grassroots' share of exploration and the share of miners' revenue directed to exploration at historical lows, will need to turn around if the thinning project pipeline is to be effectively addressed."

WESTERN ALASKA

Graphite One Inc. announced results from its fall 2018 drilling program at its Graphite Creek deposit near the town of Teller on the Seward Peninsula. The program consisted of 801 meters of drilling in six core holes that have upgraded and expanded the previously released indicated and inferred resources. Significant result from the 2018 drilling include 8.5 meters grading 10.81 percent carbon as graphite in hole 18GS022; 4.6 meters grading 12.27 percent carbon as graphite in hole 18GS023; and 16.3 meters grading 11.93 percent carbon as graphite in hole 18GS026. At a 5 percent cut-off grade, the deposit contains 10.95 million metric tons of measured and indicated resources averaging 7.8 percent (850,534 metric tons) carbon as graphite; plus 91.89 million metric tons of inferred resource averaging 8 percent (7.34 million metric tons) carbon as graphite, according to an updated resource published on Feb. 26. This deposit remains open to expansion to the east, west and north. The 2018 field program also included preliminary field surveying and an aerial LiDAR survey along possible access routes connecting to the existing state‐maintained road system. Surface water sampling and anadromous fish surveys were also completed adding to environmental baseline studies from previous years.

North Dynasty Minerals Ltd. announced that it has entered into a bought-deal financing to raise US$10 million, most of which will be used to advance its Pebble copper-gold-molybdenum project. Intended use of the funds includes operational expenditures, including engineering, environmental, permitting and evaluation expenses associated with the project, the advancement to completion of the United States Army Corps of Engineers Environmental Impact Study, and enhanced outreach and engagement with political and regulatory offices at the state and U.S. federal government as well as its Alaska Native partners and broader regional and state-wide stakeholder groups.

INTERIOR ALASKA

Avidian Gold Corp. announced plans for its 2019 work program at its Amanita gold prospect near Fairbanks. Exploration efforts in 2019 will focus on one or more oxide gold targets within a 1.6-kilometer-long mineralized structural corridor that trends directly onto Kinross Gold's adjacent Fort Knox gold mine property. Historical drilling along this corridor, referred to as the Tonsina Trend, indicates that oxide gold mineralization extends from surface to a depth of at least 150 meters depth. Thirty of thirty-nine historic holes in this trend intersected gold grades greater than one gram of gold per metric ton over widths 1.5 meters, with visible gold identified in six. Significant intercepts include 14 meters grading 3.02 g/t gold, 11 meters grading 1.08 g/t gold, five meters grading 2.3 g/t gold and three meters grading 14.04 g/t gold. The company is planning an initial 1,200 meters of core drilling for 2019.

Freegold Ventures Limited announced that it has entered into an agreement with a wholly owned subsidiary of South32 Limited whereby South32 has the option to earn a 70 percent interest in the Shorty Creek copper-molybdenum-gold project near Livengood. Under terms of the deal, South32 must contribute minimum exploration funding of US$10 million over a four-year option period with minimum exploration expenditures of US$2 million in each of years one and two, and US$3 million in each of years three and four. South32 may exercise its option at any time following year-one to subscribe for 70 percent of the shares of a newly formed project company by committing US$30 million to the newly formed company, less the amount of exploration expenditure contributed by South32 during the option period. After the subscription funding has been expended by the project holding company, the parties will contribute funding pro rata (70-30). Freegold will act as the operator of the project during the option period. The companies' plans for 2019 have not been released yet.

International Tower Hill Mines Ltd. announced that its Phase-12 metallurgical program has begun at its Livengood gold project. This work is part of a US$3.7 million 2019 budget and will build on the metallurgical studies undertaken in 2018 to continue to define and refine the project flowsheet. Approximately 2,000 kilograms of samples will be processed in 2019 to evaluate optimum grind size and to determine whether different recovery parameters should be applied to different areas of the orebody. The company also plans to continue environmental baseline studies needed to support future permitting.

ALASKA RANGE

PolarX Limited announced results of 3D magnetic modelling at its Alaska Range project. Airborne magnetic data suggest the Saturn magnetic anomaly, about 5,000 meters southeast of the Zackly copper-gold skarn, may be the source intrusive for copper-gold mineralization on the project. Saturn extends from near‐surface to a depth of at least 3,000 meters, has a surface area of 2,000 by 1,000 meters and plunges steeply to the south. The target is covered by 10 to 15 meters of glacial till and is blind to surface geochemistry. The magnetic core of the system is surrounded by a magnetic low, suggestive of magnetite-destructive alteration seen in some porphyry copper deposits. A 20-line-kilometer induced polarization geophysical survey is planned to locate disseminated sulfides associated with the intrusive core and in the surrounding alteration halo. The new IP data will be used in conjunction with the magnetic data to plan a follow-up drilling program.

Avidian Gold Corp. announced plans for its 2019 work program at its Golden Zone prospect near Cantwell. Additional mapping and sampling will be conducted at the newly discovered JJ Zone with the aim of establishing boundaries for the mineralization exposed at surface. The current surface footprint of the prospect remains open to expansion. Drilling is planned following initial follow-up work. Additional evaluation of the CSAMT geophysical anomalies is planned at the Copper King-Long Creek area in an attempt to relate the geophysical results to the identified intrusive related gold mineralization. Integration of geophysical, geochemical and geological data will be followed by drilling. Further drill testing of the Breccia Pipe deposit-MEZ area will be conducted to identify the root of the sulfide-rich Breccia Pipe and the source and extent of the gold mineralization in conglomerates. The company also plans to conduct project-scale mapping, prospecting and rock plus soil sampling of the entire property to follow-up work on under-explored prospects known to host significant gold mineralization, such as the Cohio prospect, and to identify other mineralized areas.

NORTHERN ALASKA

Trilogy Metals Inc. and funding partner South32 Limited announced additional metallurgical and resource estimate results from the Bornite deposit at their Upper Kobuk Mineral Projects, a business relationship owned and controlled by Trilogy and NANA Regional Corporation, Inc. Metallurgical work on nine Bornite samples have been evaluated for the recovery of copper and cobalt and the production of saleable copper concentrates. Results are consistent with previous test results and significantly expand the metallurgical database for the project. Hardness testing of the nine composites shows the materials are of soft to moderate hardness, with an average Bond Work Index of 8.94 kilowatt-hour per metric ton. Copper recoveries ranged from 80.2 to 94.5 percent and averaged 89.7 percent for eight of the nine composites. Copper concentrate grades ranged from 24.5 to 34.5 percent copper and averaged 27.6 percent. Copper concentrate quality is shown to be very good with low levels of penalty elements. Cobalt has been shown to be readily recoverable to a pyrite concentrate with grades of this concentrate in the range of 0.07 to 0.45 percent cobalt. Plans are being made for the next stage of work to determine the optimal method to recover cobalt from the pyrite concentrate. The company also indicated the recent infill drilling results have been incorporated into a new mineral resource estimate for Bornite. At a 0.5 percent copper cut-off grade, indicated in-pit resources include 40.5 million metric tons grading 1.02 percent copper while inferred resources include in-pit resources of 84.1 million metric tons grading 0.95 percent copper and underground resources, at a 1.5 percent cut-off grade, of 57.8 million metric tons grading 2.89 percent copper. For cobalt, inferred resources, at a 0.5 percent copper cut-off grade, include in-pit resources of 124.6 million metric tons grading 0.017 percent cobalt and underground resources, at a 1.5 percent copper cut-off grade, of 57.8 million metric tons grading 0.025 percent cobalt. Results suggest significant potential remains for expansion of the in-pit copper and cobalt resources. The 2019 exploration program and budget of US$9.2 million will include approximately 10,000 meters in 12 holes of infill and expansion drilling in the deposit, additional metallurgical work to optimize copper recoveries, the determination of next steps for the recovery of cobalt, and initial engineering studies to prepare Bornite for a preliminary economic assessment once the work from the 2019 work programs is completed.

Trilogy Metals and South32 also announced an update for the Arctic volcanogenic massive sulfide deposit at UKMP. Trilogy will continue to advance engineering and environmental work in 2019 in support of completing a feasibility study and preparing the Arctic project for permitting. The total budgeted amount for these activities is estimated to be US$7 million. The company also will undertake additional hydrological and geotechnical work at the site along with water management, tailings facility and waste rock containment analysis and design. Additional metallurgical test work to verify ore hardness and grinding characteristics is currently on-going with materials from the project. Trilogy and South32 also plan to jointly fund a US$2 million exploration program along the 100-kilometer (62 miles) Ambler volcanogenic massive sulfide Belt. This program will include district-wide VTEM and ZTEM airborne geophysical surveys flown on 200- and 400-meter line spacing over both the Cosmos Hills and the Ambler Belt. Both surveys are electromagnetic methods that have proven successful in identifying targets and mineralization in other volcanogenic massive sulfide districts. This survey is expected to start in mid-April and be completed by the beginning of May. The data will then be processed to identify and prioritize drill targets for follow up geologic mapping, soil geochemistry and drilling. This work will cover several other prospects with historic resources including the Horse, Sunshine, Shungnak, and BT prospects.

SOUTHEAST ALASKA

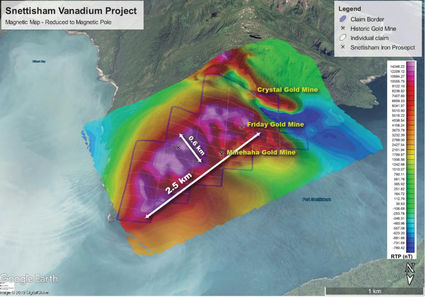

Northern Cobalt Limited announced preliminary results from 3D modelling of a detailed helicopter-borne magnetic survey over its Snettisham vanadium project in southeast Alaska. The survey was conducted over a Ural-Alaska type mafic-ultramafic intrusive complex which is host to significant concentrations of titaniferous and vanadium bearing magnetite and has several historic gold mines in the vicinity. Depth modeling suggests the top of the magnetite body is within 50 meters depth with a large carrot-shaped body modeled at 70 percent or more magnetite extending to depth. Historical drilling was undertaken too far up the hill and at too shallow an angle to test the main magnetic anomaly. As modeled, the project hosts a large magnetite body measuring 2,500 meters long, up to 600 meters wide and over 2,000 meters deep. The company plans to complete three diamond drill holes to test the 3D model at Snettisham. These holes have been designed to test the depth to high-grade magnetite mineralization, test the primary grades of iron and vanadium mineralization, obtain samples for beneficiation testing and test the concentrate grades for vanadium, titanium and iron along with levels of deleterious elements. The company also reported that the local geology is well suited to hosting Juneau Gold Belt style gold mineralization which occurs within fault and shear structures similar to those hosting the historic Crystal, Friday and Minehaha mines on the project. The recently completed magnetic survey allows mapping of these structures that are otherwise obscured by vegetation and overburden. The company is planning to undertake rock chip, stream sediment sampling and mapping on these gold prospects to identify drill targets for follow-up exploration.

Northern Cobalt Ltd.

This map shows the large magnetic anomaly at Northern Cobalt's Snettisham vanadium project in Southeast Alaska.

Zarembo Minerals Company announced additional results from 2018 efforts at its Frenchie volcanogenic massive sulfide prospect near Wrangell. The project is located near existing roads on land that is open to both road building and mineral development. The Frenchie prospect is hosted in the same Triassic Hyd Group volcanic rocks as Hecla Mining's Greens Creek mine on Admiralty Island (current resources of greater than 240 million ounces of silver with past production of more than 228 million oz of silver, 1.5 million oz of gold, 1.6 million tons of zinc and 500,000 tons of lead). Previous drilling by Zarembo at the Frenchie prospect intersected 15 feet of massive sulfide mineralization starting at 21 feet depth that returned intervals of 1 to 7 feet grading 0.39 to 1.575 percent copper, 0.05 to 0.23 percent lead, 1.54 to 2.76 percent zinc, 0.65 to 2.02 grams of gold per metric ton and 8.6 to 21.5 g/t silver. Both copper-lead-zinc-silver-gold massive sulfide-rich mineralization and "white" barite-rich sulfide mineralization occur on the prospect. Recent sampling indicates massive sulfides at Frenchie exhibit significant gold enrichment and suggest that past sampling likely contained false-negative values for gold. Limited drilling and airborne geophysics suggest the prospective Hyd Group rocks are mineralized over an area measuring at least 20 kilometers (12.4 miles) long by up to six kilometers (3.7 miles) wide. Prospective Hyd Group rocks are covered by younger rocks to the northeast and southwest, suggesting the actual extent of prospective stratigraphy is significantly larger than what is mapped at surface. Two and three-dimensional interpretation of airborne magnetics and resistivity suggests conductive rocks similar to massive sulfide and barite-sulfide mineralization outcropping in the Frenchie area are widespread well outside areas tested by past drilling. The company is seeking technically and financially capable parties interested in assisting in developing the project.

Curtis J. Freeman CPG #6901

Avalon Development Corp.

P.O. Box 80268

Fairbanks, AK 99708

Phone: 907-457-5159, Fax 907-455-8069

Email: [email protected]

Website: http://www.avalonalaska.com

Reader Comments(0)