PEA outlines robust Pine Point zinc mine

Mining Explorers 2020 - Published January 19, 2021

Last updated 1/18/2021 at 11:04am

Osisko Metals Inc.

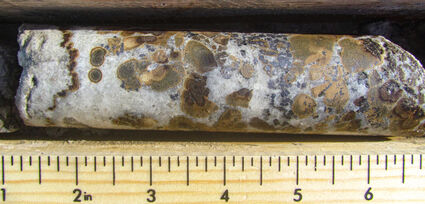

Core from drilling into high-grade zinc mineralization at Osisko Metals' Pine Point project in Northwest Territories.

With a vision to become a leading base metals mining company, Osisko Metals Inc. is rapidly advancing exploration and engineering studies at its Pine Point project about 42 kilometers (26 miles) east of Hay River, Northwest Territories.

A preliminary economic assessment completed in mid-2020 outlines a mine at Pine Point that would produce an average of 327 million pounds of zinc and 143 million lb of lead annually over an initial 10-year mine life.

At an average zinc price of US$1.15/lb and lead averaging US95 cents/lb, this operation has been calculated to produce an after-tax net present value (8% discount) of C$500 million and an internal rate of return of 29.6%. It is expected to take 2.8 years to pay back the C$555 million in initial capital costs to develop the mine.

"On a zinc-only basis, Pine Point could potentially, if it entered into production, become a low-cost zinc-lead producer ranking fourth largest in the Americas and ninth in the world, yielding an exceptionally clean and high-grade zinc concentrate," said Osisko Metals Executive Chairman and CEO Robert Wares.

This would not be the first time Pine Point hosted a significant North American zinc mine. From 1964 to 1988, Cominco (now Teck Resources) produced roughly 14 billion lb of zinc and 4 billion lb of lead from around 64 million metric tons of ore averaging about 10% zinc-equivalent.

Cominco, however, left plenty of quality zinc mineralization over a 50-kilometer- (31 miles) trend at Pine Point.

According to a calculation updated for the PEA, Pine Point hosts 12.9 million metric tons of indicated resource averaging 4.56% zinc and 1.73% lead, which equates to 6.29% zinc-equivalent; plus 37.6 million metric tons of inferred resource grading 4.89% zinc and 1.91% lead, which equates to 6.8% zinc-equivalent.

This includes 12.9 million metric tons of surface mineable indicated resource averaging 4.56% zinc and 1.37% lead, or 5.48% zinc-equivalent; 27.2 million metric tons of surface mineable inferred resource averaging 4.11% zinc and 1.73% lead, or 6.29% zinc-equivalent; and 10.5 million metric tons of underground inferred resource averaging 6.93% zinc and 3.3% lead, or 10.23% zinc-equivalent.

The mine outlined in the PEA envisions delivering 11,250 metric tons of ore per day from 47 open pits and eight underground mines to a central processing facility.

"The current PEA concept is a large-scale operation, where the mineral resource mined would be sourced mainly from small, near-surface open pits with additional contributions from eight high-grade, shallow deposits mined by underground methods from the West and Central Zones," said Osisko Metals President and CEO Jeff Hussey. "While the PEA already outlines a base-case for a potential top-ten zinc producer of high-quality clean concentrate, we foresee several areas for improvement as we continue to optimize these great initial economic metrics and move towards initiating a feasibility study."

One such area is expanding the already large zinc resource, which was the target of drilling that got underway in late August.

This roughly 5,000-meter program focused primarily on expanding the boundaries of 11 deposits within the East Mill, Central and North zones at Pine Point; as well as around orphaned holes where Cominco cut high-grade mineralization but did not follow-up with additional drilling.

Much of this drilling targeted O53, a deposit within Central Zone at Pine Point that shows enormous potential for expansion at depth and along strike.

Highlights from four holes testing O53 at depth include 17.5 meters averaging 11.53% zinc and 2.52% lead in O53-20-PP-001; and 28.8 meters averaging 23.9% zinc and 6.24% lead in O53-20-PP-012.

While these holes indicate the depth expansion of O53, it is the strike expansion potential of this deposit that is most intriguing.

This potential was first confirmed in hole O53-20-PP-003, which cut three meters averaging 8.45% zinc about 135 meters west of O53 and well outside the boundaries of the current pit-constrained resource there.

OM13-20-001, drilled 665 meters further west, cut 4.8 meters averaging 7.25% zinc and 1.45% lead roughly 800 meters west. Osisko believes the well-developed, near-surface, tabular-style mineralization tapped in OM13-20-001 is within a 60-meter-wide corridor that extends back to the O53 deposit.

Considering the currently defined resource at O53 is only about 300 meters long and 60 meters wide, this could potentially mark a major expansion of the deposit.

Osisko said further high priority drilling will be designed to test continuity of mineralization along the 800-meter strike length separating the O53 deposit and the target intersected in OM13-20-001.

"The new trend of tabular mineralization west of O53 is a prime example of the excellent exploration potential remaining at Pine Point," said Hussey.

Reader Comments(0)